Our Mission

Redefine individual-capital relationships through AI

Our Vision

Not following trends — creating the future of finance

Our Commitment

24/7 Intelligent Financial Agent, growing your wealth

9M Founded in New York by former Goldman Sachs executives, Columbia University AI scientists, and top quant engineers. Known as ” Your AI Financial Advisor with Wall Street Expertise”.

9M AI operates through nine cognitive modes,addressing key challenges in financial decision-making.

All live trading addresses are on-chain and publicly verifiable.

Assets are on-chain, 9M has no access, protected by multisig and audits.

9M AI evolves weekly—designed to learn and improve over time.

270 Billion

Model Parameters (Web3 Finance Ready)

7

Supported Asset Classes (Stocks, Options, Bonds, etc.)

40 Million

Academic Papers Collected

1 Billion

Financial News Items Aggregated

270 Billion

Model Parameters (Web3 Finance Ready)

7

Supported Asset Classes (Stocks, Options, Bonds, etc.)

40 Million

Academic Papers Collected

1 Billion

Financial News Items Aggregated

Chris Chang,9M CEO

Chris Chang is a self-made entrepreneur and visionary investor with astrong track record of building and scaling cross-industry ventures. In2009, he founded an LED manufacturing company serving Fortune 500 clients, theU.S. government, and military sectors-leading it to a successful NASDAQlisting in 2012. (Read more)

As CEO of 9M, Chris brings deep business acumen and bold innovation to the AI-powered investment space, shaping a new ecosystem at the intersection of finance and technology. His diverse portfolio spans investments in Scottish whisky brands and Hollywood film financing, reflecting a keen eye for high-impact opportunities.

AI & Quantitative Research Division (Team Size: 24)

- 7 PhD-level AI scientists (Columbia, MIT)

- 9 senior quant researchers (math, physics, ML)

- 8 financial data scientists (HFT, risk modeling)

Key achievements:

- NovaMind™ proprietary model series

- Reinforcement learning for market behavior

- Adaptive multi-factor modeling

Engineering & Infrastructure Division (Team Size: 15)

- 6 system engineers (low-latency trading)

- 4 cloud experts (AWS, Kubernetes)

- 5 backend engineers (deployment, risk systems)

Key achievements:

- Model containerization pipelines

- High-performance backtesting systems

- Secure trading infrastructure

Fund Management & Investment Strategy (Team Size: 8)

- Ex-portfolio managers from Goldman Sachs, Citadel, Bridgewater

- Experts in cross-asset portfolios, liquidity modeling, and capital allocation

Focus:

- Risk-adjusted fund structuring

- Alpha preservation

- Expansion into equities, crypto, and derivatives

Compliance, Operations & Investor Relations (Team Size: 6)

- Compliance officers across U.S., Singapore, Europe (global filings & licensing)

- Investor relations specialists with Wall Street communication expertise

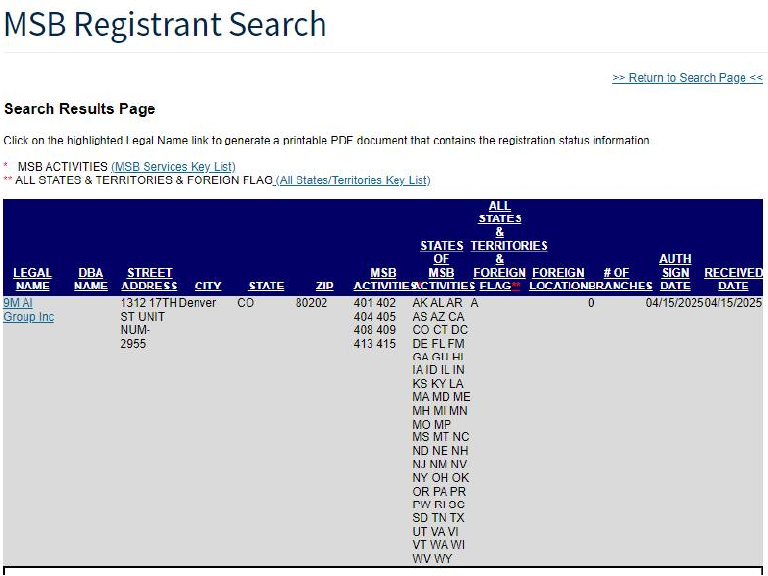

U.S MSB License

U.S. NFA Filing

U.S. SEC Filing

-

2019

Founded in Manhattan, New York; launched the AI Finance Lab

-

2021

Released the first prototype of the NovaMind™ system

-

2022

Made its public debut at the "AI & The Future of Finance" Forum in the U.S.

-

2025

Achieved licensing verification under U.S. MSB and NFA; initiated compliance filing for Canada MSB

-

Ongoing Expansion

Scaling intelligent wealth management across multi-scenario applications